Each year, Canadian employers collect and remit hundreds of billions of dollars in personal income taxes, Canada Pension Plan (CPP) contributions, and Employment Insurance (El) premiums in addition to other payroll taxes and levies.

Remittance and compliance activities completed by payroll are essential to the functioning of Canada’s taxation and social program systems, and play an important role for governments, organizations, and individuals. Remittances associated with payroll account for 37 per cent of total revenue to federal, provincial, and territorial governments [1], and are a mechanism to administer a range of programs and benefits.

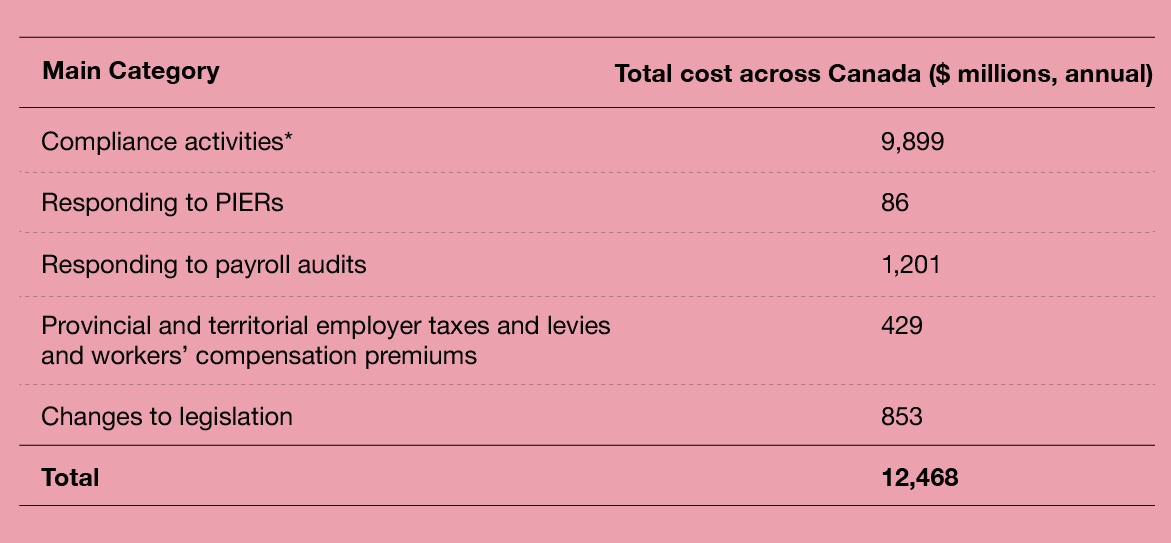

The cost of compliance activities borne by Canadian employers is significant. PwC Canada estimates the cost to Canadian employers is approximately $12.5 billion per year

To put this number into context, it is equivalent to 1.3 per cent of total wages and salaries paid in Canada, and 2.1 per cent of total corporate profits. On a per-employee basis, these costs are larger for small businesses, which are unable to take advantage of economies of scale in system setup, administration and reporting. Canadian employers collect $345 billion in statutory remittances annually, meaning that employers pay $0.36 for every $10 collected. [2]

Canadian payroll remittance and regulatory requirements can be divided into six categories:

- Individual income taxes

- Social program withholding: Canada and Quebec Pension Plan contributions, EI premiums, and Quebec Parental Insurance Plan premiums

- Workers’ compensation premiums

- Provincial and territorial health/post-secondary education taxes and levies

- Pension regulations

- Employment and labour standards as they pertain to payroll specific obligations

PwC Canada estimates that on average, 56 per cent of time spent in payroll functions is related to compliance, meaning that the total cost of these functions to employers is approximately $9.9 billion.