In addition to the approximately $9.9 billion in employer costs related to compliance activities, there is a cost for activities directly related to additional work required as a result of non-compliance (actual or perceived).

The report quantifies the approximate cost of these additional resource activities borne by employers to be $1.7 billion, or 14 per cent of the total cost of compliance.

These additional activities include:

- Responding to payroll-related information requests from the CRA

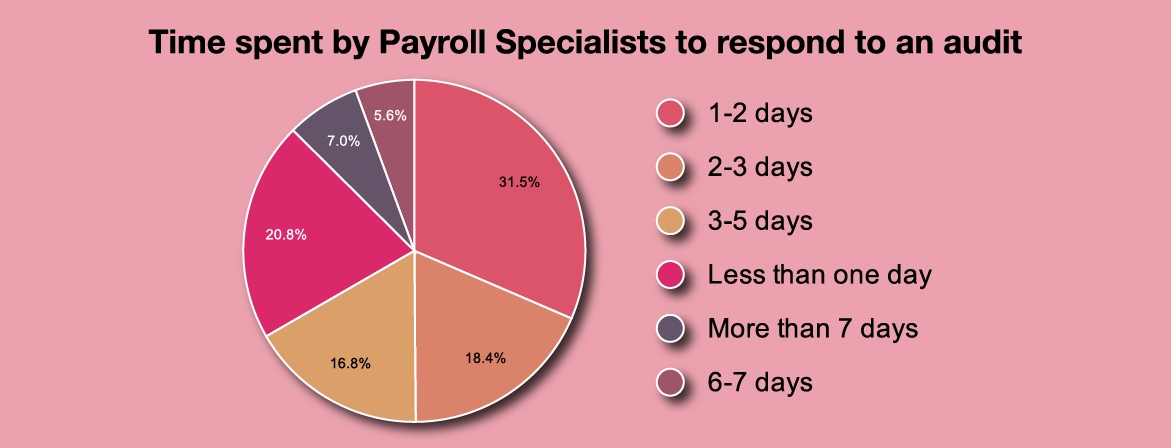

- Facilitating payroll audits

- Processing trust exam notifications

- Conducting Pensionable and Insurable Earnings Reviews (PIERs)

- Meeting provincially regulated payroll obligations such as employer health and post-secondary education taxes and levies, as well as Workers’ Compensation Board requirements

In estimating the total cost of employer compliance for this report, PwC Canada did not incorporate indirect costs such as:

- Legal fees

- Third party provider costs

- Service charges from payroll software service providers

- Professional membership fees

- Activities not directly related to the payroll function, such as strategy and planning

- Hours required by individuals in finance for approving overall payroll reporting

These indirect costs are significant.