This report investigates three areas where policy changes could lower the cost of compliance, increasing Canada’s attractiveness to investment in an increasingly competitive market. One way to achieve this is by simplifying the taxation system, starting with taxable benefits.

Canada’s outdated tax system creates undue costs — in terms of both money and time — for Canadian businesses [1]. Identifying opportunities to simplify the taxation system would be particularly beneficial during times of economic crisis when employers are already facing complex challenges.

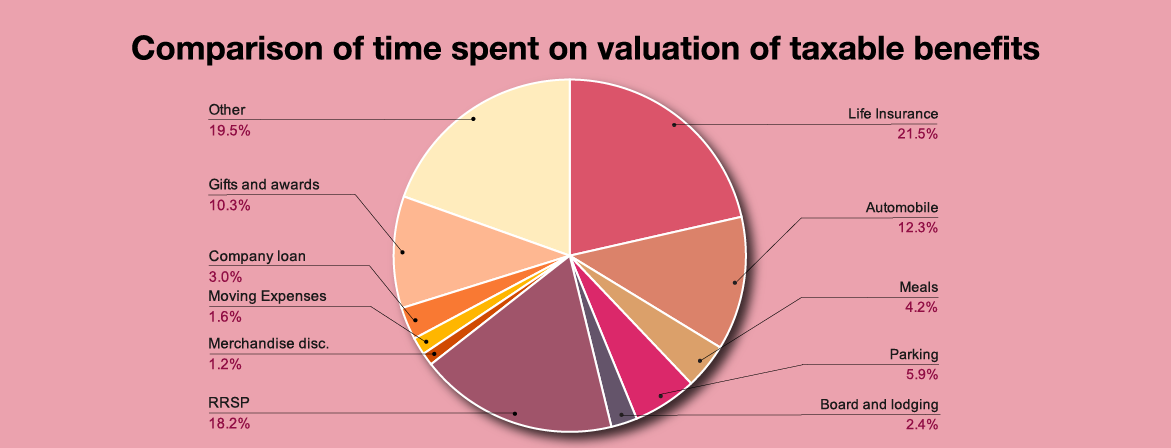

One of the most onerous responsibilities with respect to reporting compensation is the accurate identification and valuation of taxable benefits.

It is the responsibility of the payor (i.e. the employer) to determine who the primary beneficiary of the economic outlay is. While most companies try to fully comply, the administrative complexity behind timing and valuation of benefits like parking, can make it difficult to administer taxable benefits correctly.

The government should revisit certain legislation in order to simplify the taxable benefit rules. Specifically:

- Employer provided parking lots, unrestricted to the public, should not trigger a taxable benefit for employees

- Gift cards should be included as non-taxable under the CRA’s Gifts and Awards policy

- Tax-free benefit thresholds should be reviewed and indexed with inflation

In addition to lowering the cost of compliance to employers, simplifying taxable benefit rules would greatly enhance employer compliance. Increased accuracy would, in turn, result in proper receipt of any associated tax revenue while decreasing government resources required to perform audits.